Judge Your Decisions, By Your Decisions.

At the risk of this post sounding like a book review, I

Share this post

Have you ever really thought about what happens when you fire up a trading platform, and decide to place a trade? It’s easy to think of it as just you and a sea of numbers, or like you’re playing a game of solitaire on the computer. But the reality is quite different, and much more brutal.

Entering the markets is like walking into an arena packed with people and robots, while you hold your wallet (stuffed with cash), out in front of you for all to see. Everyone who enters, does so while announcing:

“This is my money. If you can take it from me, it’s yours. But if I can take yours from you, then it’s mine!”

A free-for-all ensues, with everyone doing everything in their power short of actually making physical contact of any kind, to take money from everyone else, all while preventing anyone from taking money from themselves.

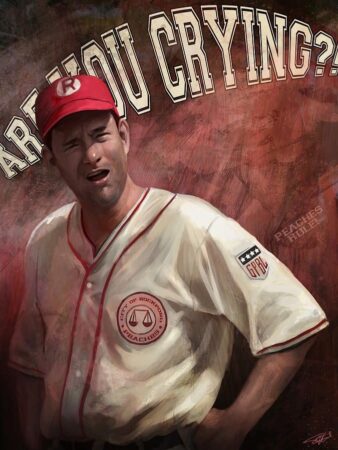

Now, really picture that. Burn it into your brain. Because the fact is that in trading, you are on your own. You have no friends “in the pits.” (I know, we all trade electronically, but go with me here!) Nobody will lift a finger to keep you from adding to a losing trade, or over-leveraging, or fighting the dominant direction, or trading a news release, or any of countless other bad ideas. There are almost no rules at all in fact! It’s every man, woman, or bot for themselves and if you’re broke at the end of the day, not a single participant will cry for you.

This is the harsh reality of trading. It is an absolutely brutal endeavor, and you aren’t just trying to time your reactions against a sea of numbers. Those numbers represent decisions being made by all the other participants. Some of those decisions are openly announcing their intention, many (most?) are absolutely not, and are instead designed to fool you into letting your guard down just long enough for them to reach into your wallet, and snatch some bills.

Trading really isn’t a game of science or math, although math can be a useful component of certain trading activities. It’s a game of speed, psychology, reflexes, nerves, and discipline. If you’re weak in any of those areas, you won’t even realize how badly the odds are stacked against you, until you notice your wallet has gotten much lighter. So take a careful personal inventory of these elements of yourself, and if you find you’re weak in any of these areas – even just slightly – make sure you focus on them and shore them up quick Because you know some other trader is doing exactly that!

Until next time, good trading!

Jonathan van Clute

Community Manager, Trading Research Group

Share this post

You Might Also Be Interested In:

At the risk of this post sounding like a book review, I

As I write this, it’s mere hours away from the clock striking

Well seeing as how it’s “the day after Black Friday” in the

There is a risk of loss in futures, forex and options trading. There is risk of loss trading futures, forex and options online. Please trade with capital you can afford to lose. Past performance is not necessarily indicative of future results. Nothing in this site is intended to be a recommendation to buy or sell any futures or options market. All information has been obtained from sources, which are believed to be reliable, but accuracy and thoroughness cannot be guaranteed. Readers are solely responsible for how they use the information and for their results. Trading Research Group does not guarantee the accuracy or completeness of the information or any analysis based thereon.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

This presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

Testimonials and reviews appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

© 2022 Make Ticks LLC dba Trading Research Group. All rights reserved. TickMaker™ is a trademark of Make Ticks LLC.